is idaho tax friendly to retirees

Idaho residents must pay tax on their total income including income earned in another state or country. The recipient of the retirement benefits must be at least 65 years old OR be classified as disabled and at least 62 years old.

Will You Withhold Idaho Income Tax For Retirees Who Live In Idaho 2022

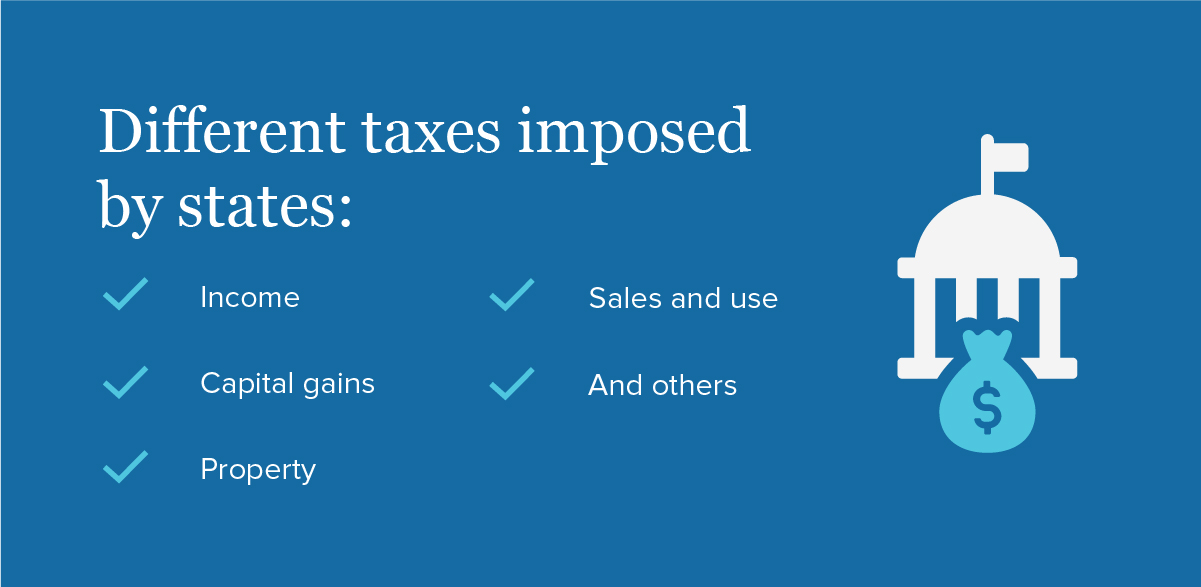

California will tax you at 8 as of 2021 on income over 46394.

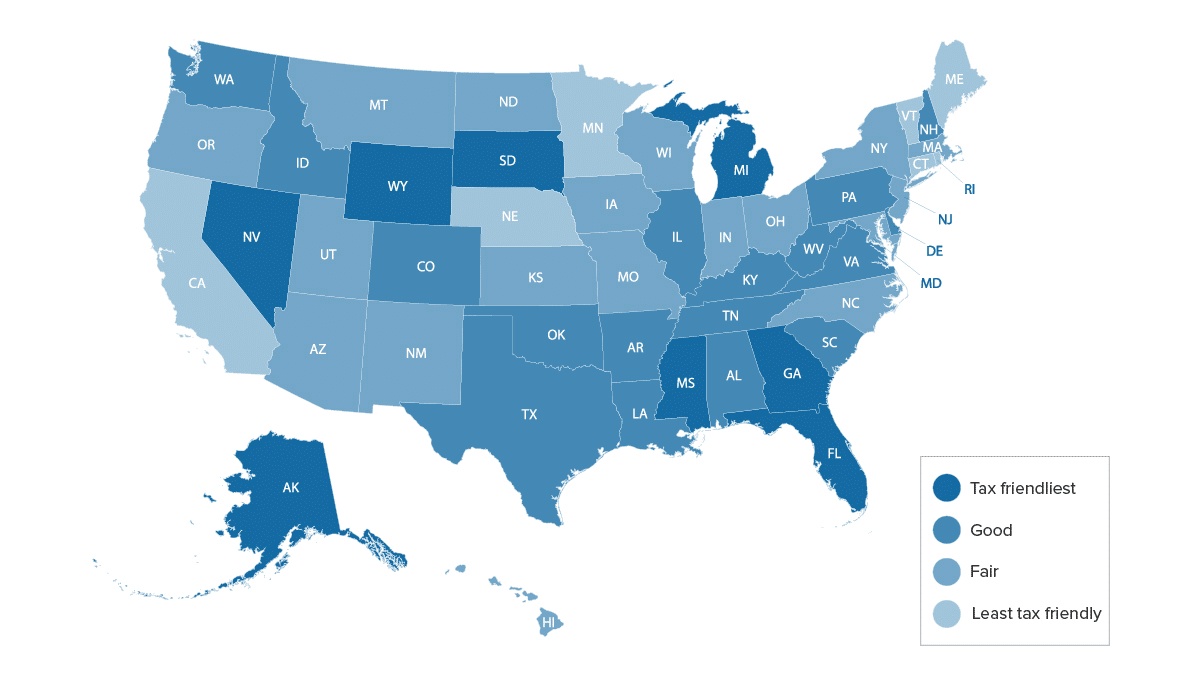

. States like Alaska Floriga Georgia and Nevada are some of the tax-friendliest for retirees. Idaho allows for a subtraction of retirement income on your state return if the taxpayer meets both parts of the two-part qualification that the state requires. There is also a 25-mile Greenbelt around Boise for seniors to walk jog or bike and take in stunning city views.

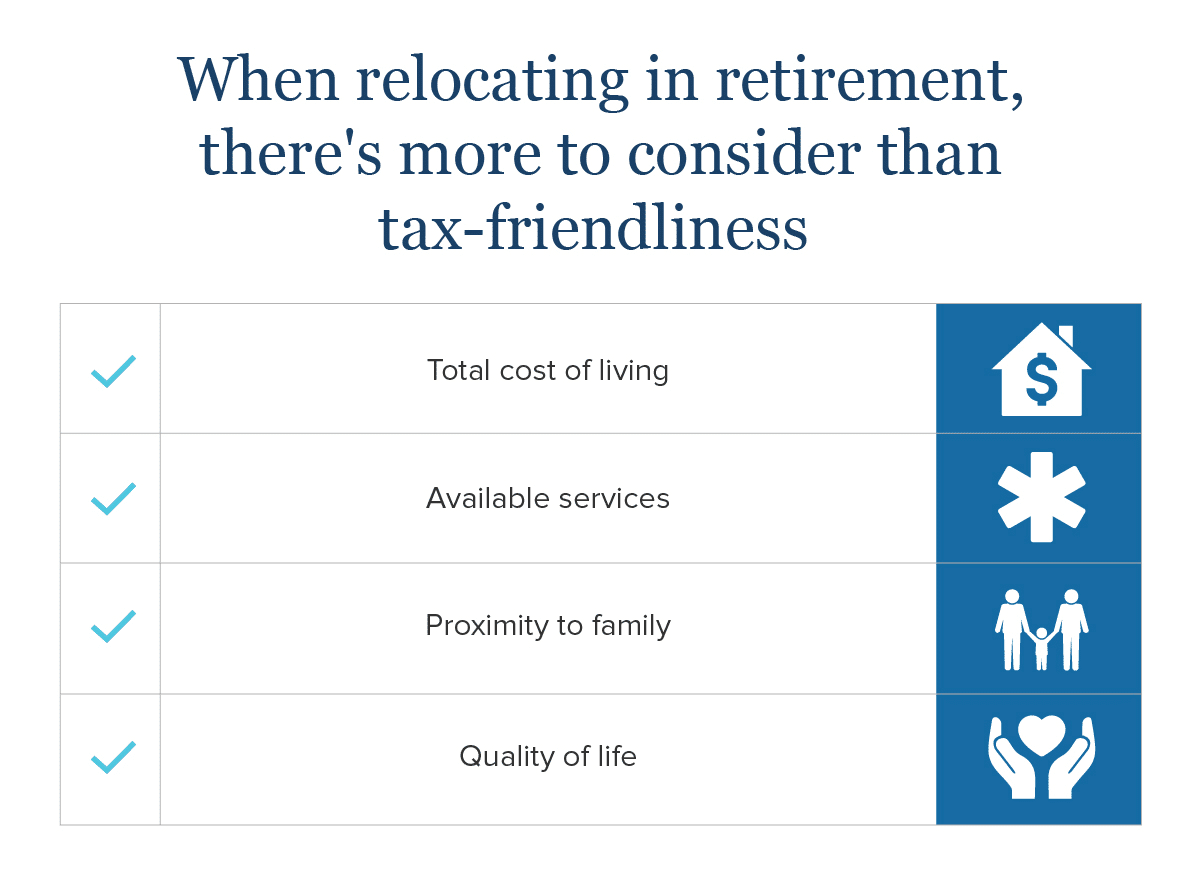

This is why if you are a retiree with a fixed income you might prefer tax-friendly states. All the cities listed below have a tax burden of 169. To determine the best places to retire in Idaho we weighed a number of different factors crucial to retirement.

In this case the state is coming in at 6 due to it being quite tax friendly for retirees. An individual who is recognized as disabled by the Social. If you have a 500000 portfolio get this must-read guide by Fisher Investments.

Idaho is tax-friendly toward retirees. Benefits of Retiring in Idaho. Recipients must be at least age 65 or be classified as disabled and at least age 62.

Tax burden in retirement for each city comes from 2018. Veterans can minimize how big a bite taxes take by choosing from states that dont tax military retirement. New Look At Your Financial Strategy.

State Sales Tax Rate. Sales tax in Idaho comes in at a low 6 and prescription drugs as well as income from Social Security are not taxable. Low property tax is especially important for many retirees who may live in larger homes but have limited income streams.

323 on all income but Social Security benefits arent taxed. Part-year residents must pay tax on all income they receive while living in Idaho plus any income they receive from Idaho sources while living outside of Idaho. Estate and Inheritance Tax.

Three main types of state taxesincome tax property tax and sales taxinteract. Tax friendly states charge fewer taxes that might apply to retirees like income tax capital gains tax property tax and sales tax. Use the instructions for.

This is not the most ideal number out there with many cities in. 255 on up to 54544 of taxable income for married filers and up to 27272 for single filers. The Idaho Retirement Benefits Deduction may be available to retirees who are both disabled and receive a qualifying source of retirement income.

The state has over 30 state parks and includes part of Yellowstone National Park. Arizona Taxes on Retirees. This guide lists some resources that can be useful to Idaho senior citizens and retirees.

29 on income over 440600 for single filers and married filers of joint returns 4 5. To determine the best places to retire in Idaho we weighed a number of different factors crucial to retirement. State Income Tax Range.

Whats more Idaho is tax-friendly for retirees. Find specific information relating to. How We Determined the Best Places to Retire in Idaho.

Part 1 Age Disability and Filing status. Access to Stunning National Parks. Ad Read this guide to learn ways to avoid running out of money in retirement.

Idaho considers the following individuals to be disabled.

Surprising Data Reveals The Top 25 Tax Friendly States To Retire Gobankingrates

Most Tax Friendly States For Retirees Ranked Goodlife

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Idaho Retirement Tax Friendliness Smartasset

Most Tax Friendly States For Retirees Ranked Goodlife

Map Here Are The Best And Worst U S States For Retirement In 2020

4 Best Places To Retire In Idaho On A Budget

Idaho Retirement Taxes And Economic Factors To Consider

State By State Guide To Taxes On Retirees

What Are The Benefits Of Retiring In Idaho 2022

7 States That Do Not Tax Retirement Income

Idaho Retirement Tax Friendliness Smartasset

Some States Are Lowering Taxes To Entice Retirees To Relocate Legacy Planning Law Group

Most Tax Friendly States For Retirees Ranked Goodlife

18 Pros And Cons Of Retiring In Idaho 2020 Aging Greatly

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Idaho Retirement Tax Friendliness Smartasset